We have developed the tbi bank app — a full-fledged online service for customers that made tbi one of the most digitalized banks in Europe.

Neobanks are the future

Neobanking is the latest trend in the fintech industry where banks go fully online.

Products and services are available 24 hours a day to any customer that has a smartphone. You no longer need to visit the bank’s physical office — all possible issues can be resolved via technical support.

On top of this, switching to an online format allows the bank to cut down expenses on rent, equipment and employees and, therefore, reduce the service costs for its customers.

tbi's digital transformation

tbi is a neobank based in Eastern Europe that also operates in Bulgaria, Romania and Greece and is preparing for expansion. The app is in line with the newest technologies and user habits shaped by such industry giants as Facebook and Google. This is an integral part of any digital product development process.

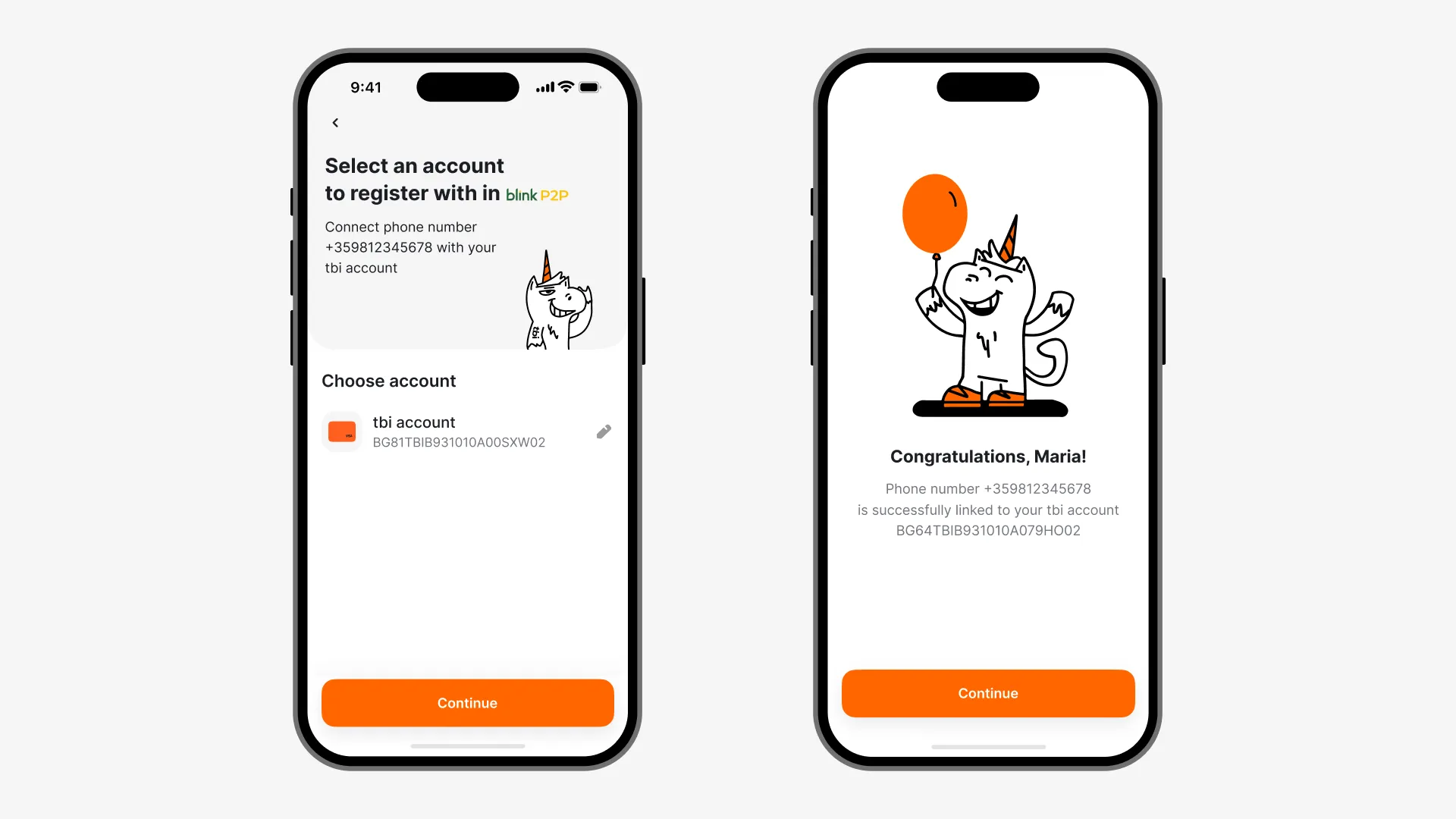

Easy access

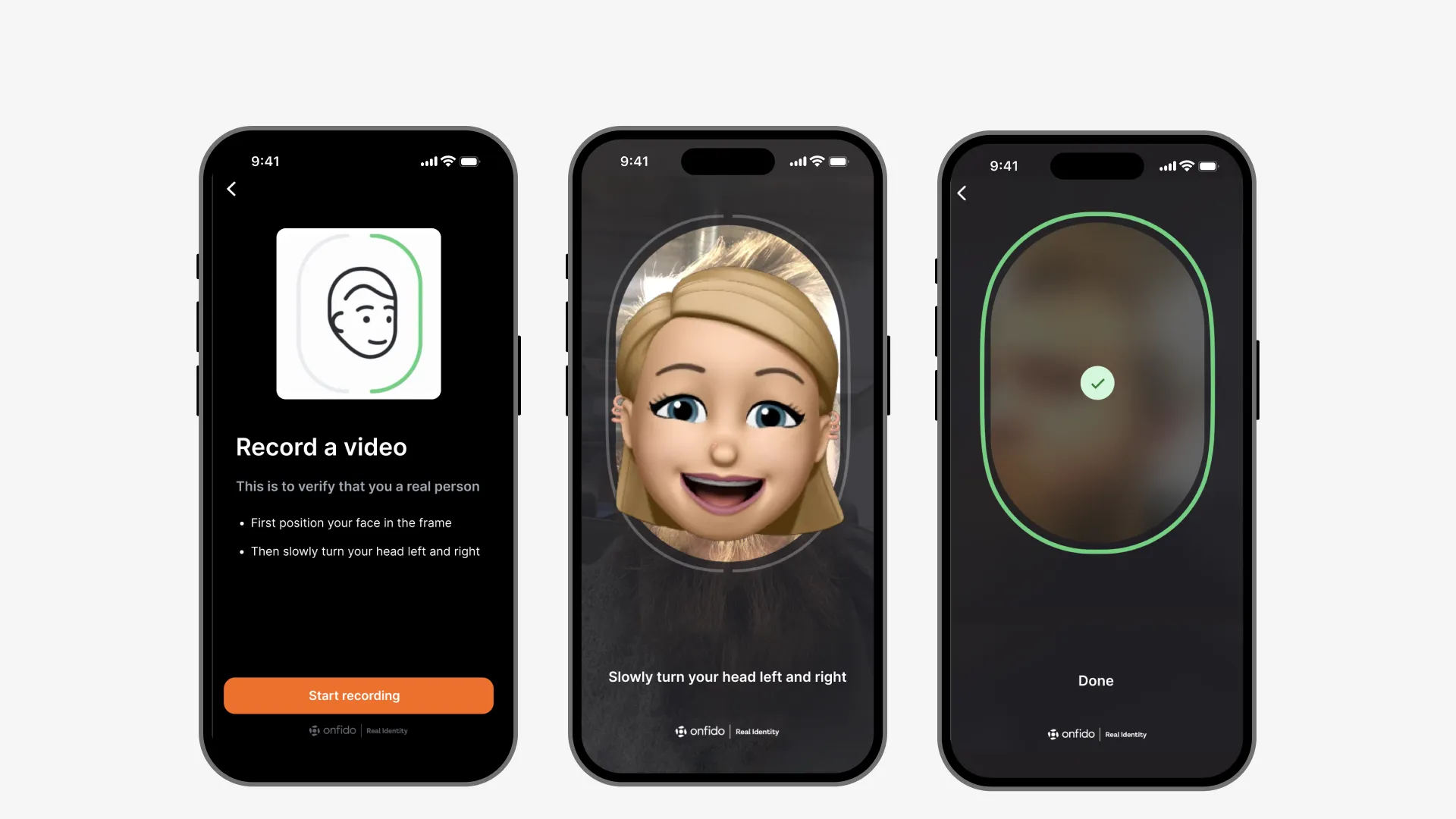

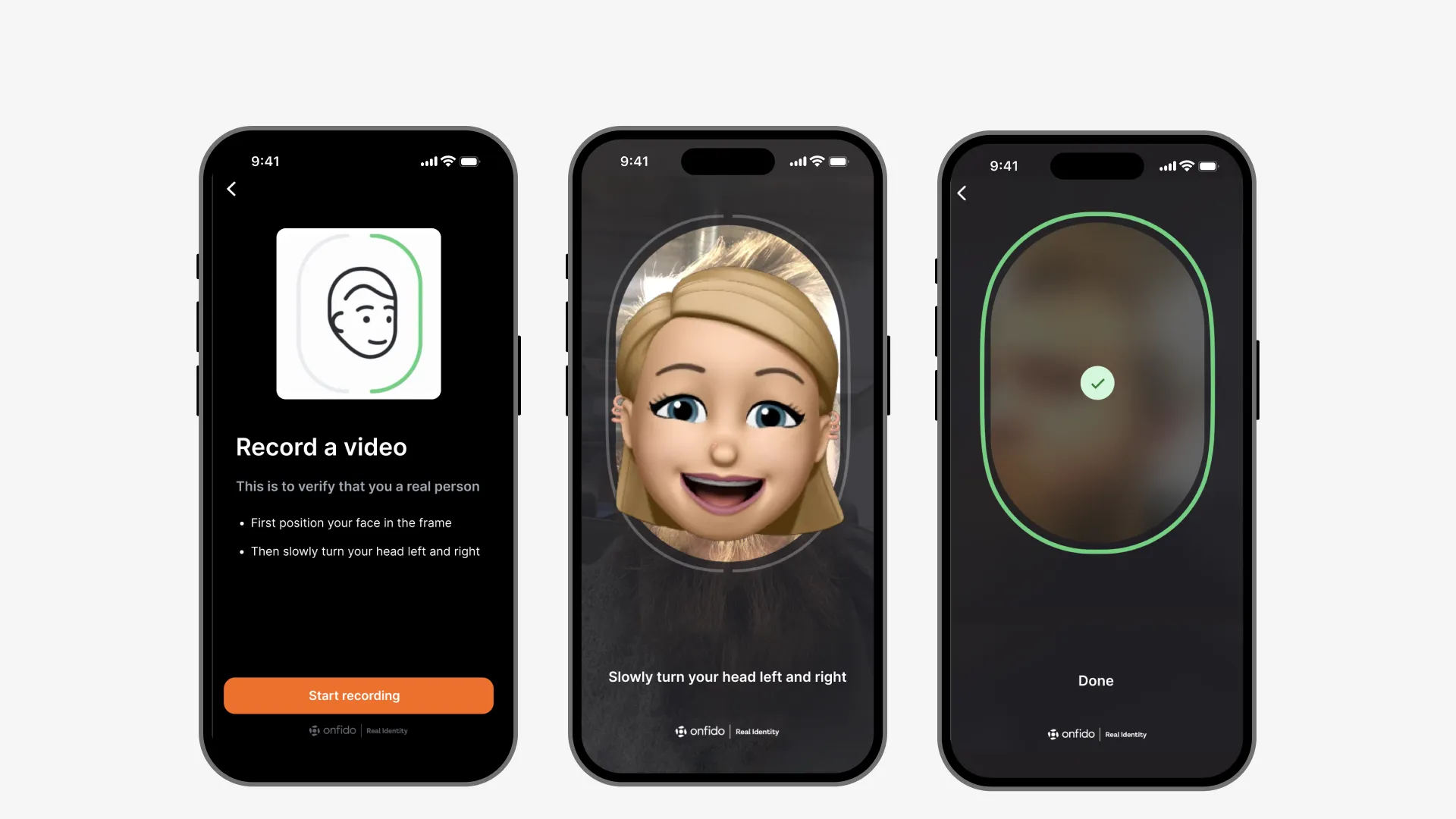

Access to the main functionality can be obtained in a couple of seconds — all you need is a phone number and a one-time verification code.

To issue a virtual or physical card or to open more complex products, for example a credit card, full identification is required: biometrics, self-ID and consent to data processing. This ensures security and proper customer verification.

Intuitive design

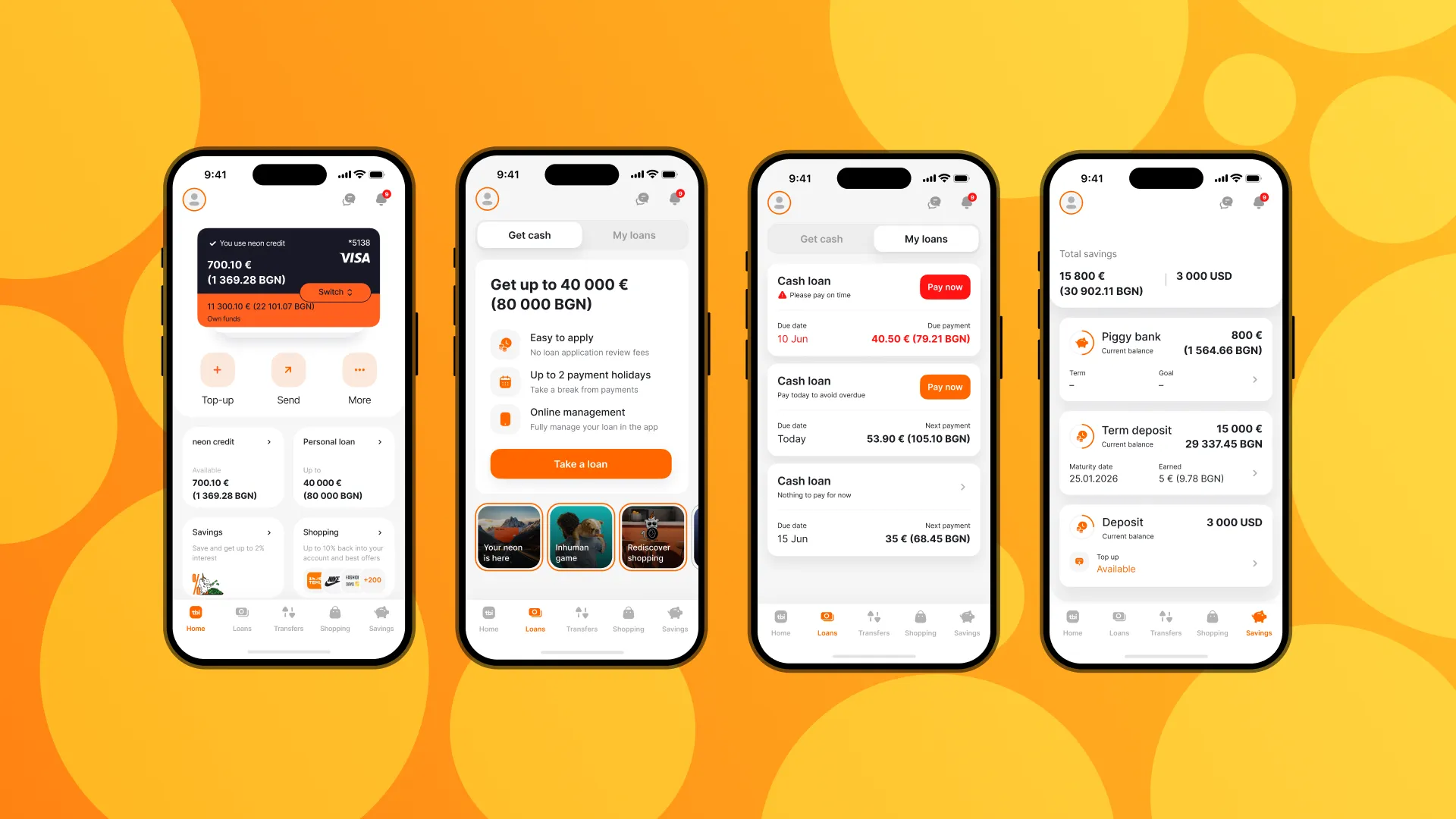

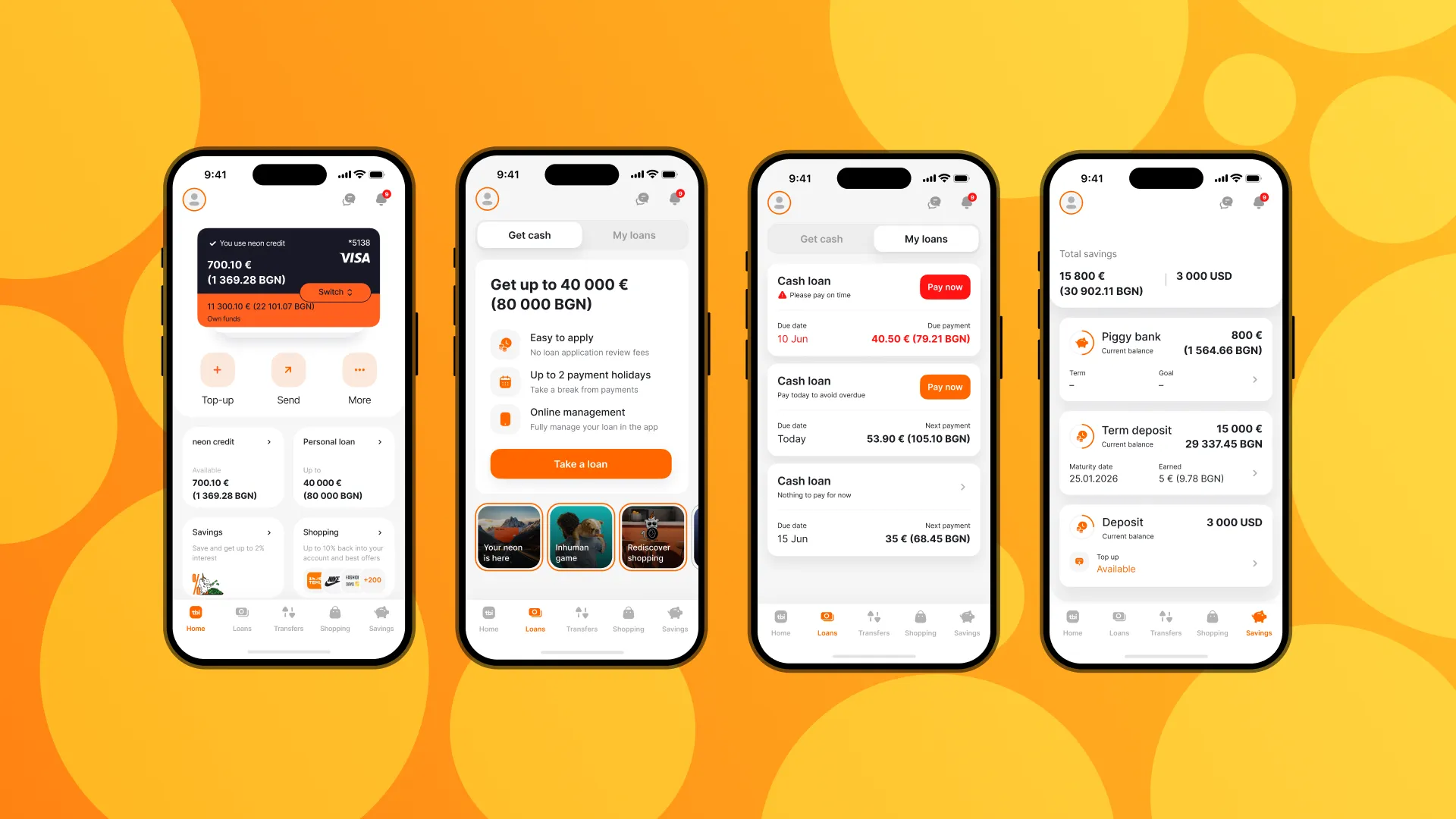

The user can easily navigate within the application and quickly find what they are looking for. For example, we took four of the most popular features and designed a separate main screen for each of them:

- Cards with the ability to switch between accounts: debit or credit,

- Credit limit,

- Current loans,

- Savings and deposits.

Switching between accounts

A single card can now be used as both debit and credit — you just switch between them using a toggle. When the toggle changes position, the balance, limit, and outstanding amount are refreshed, so the screen always shows only the relevant data for the selected card type.

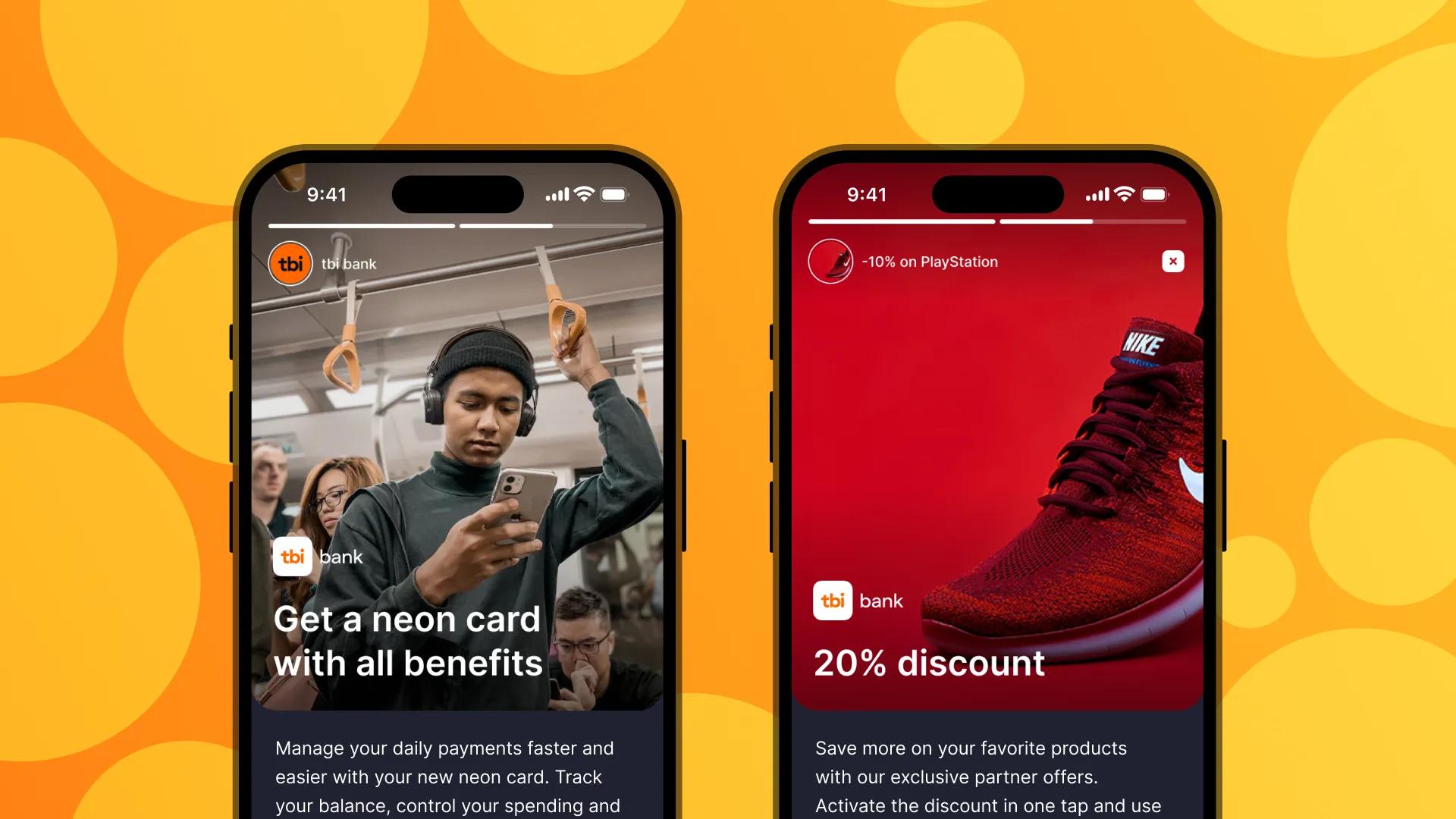

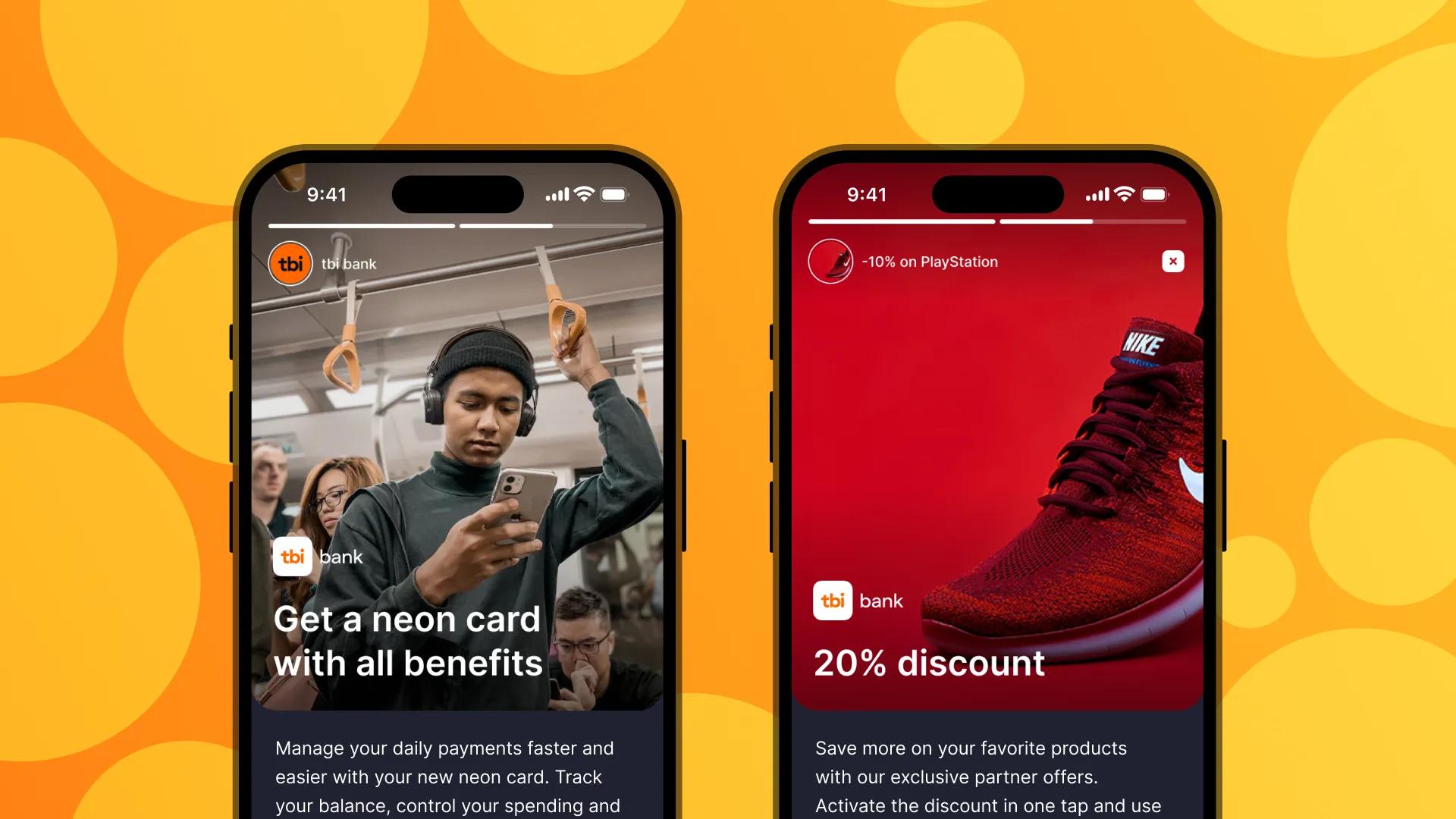

No matter what main screen is displayed, the user will not miss any promotions or special offers from partners because we added personalized stories.

An informal intermediary between the client and the bank

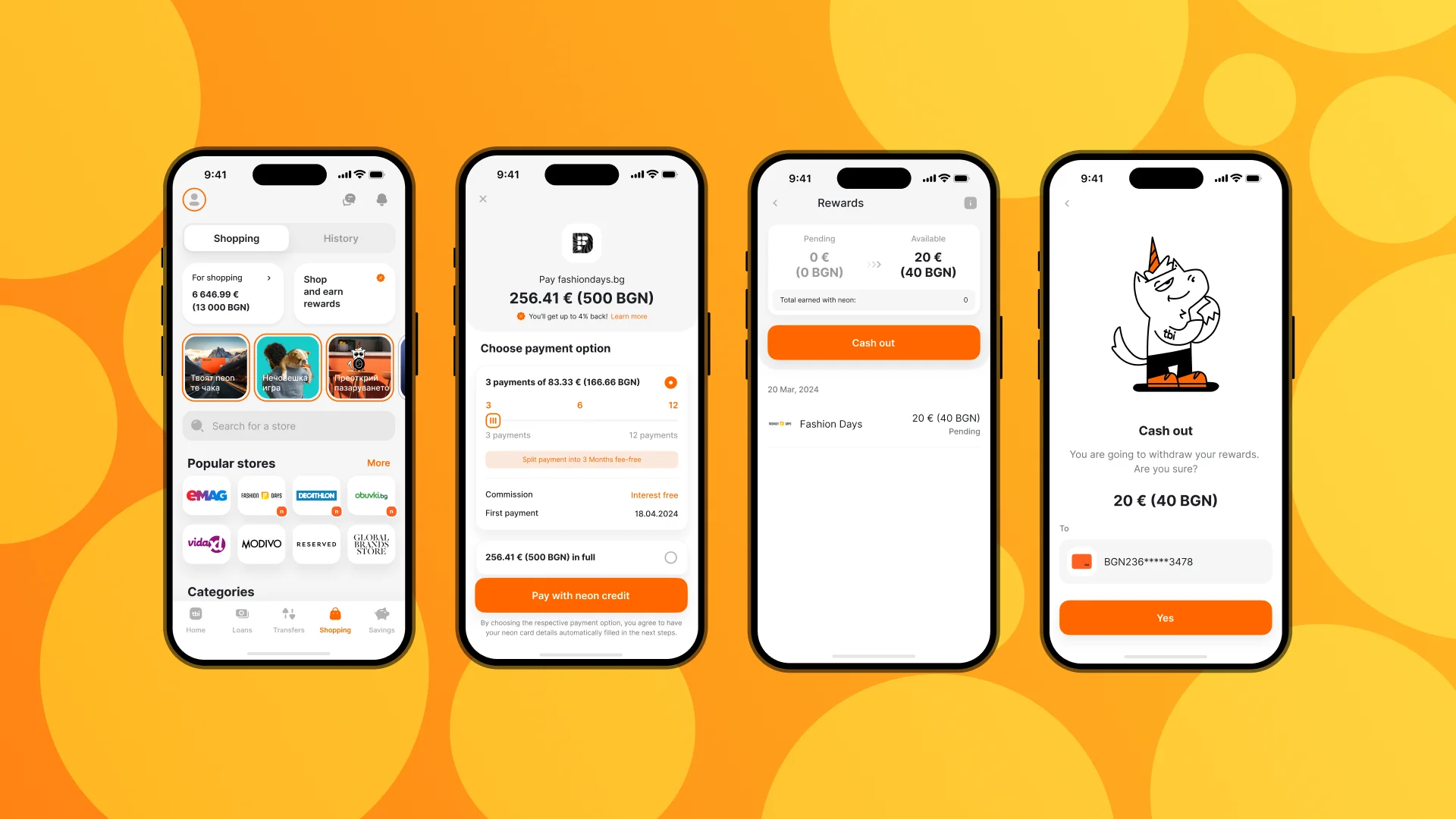

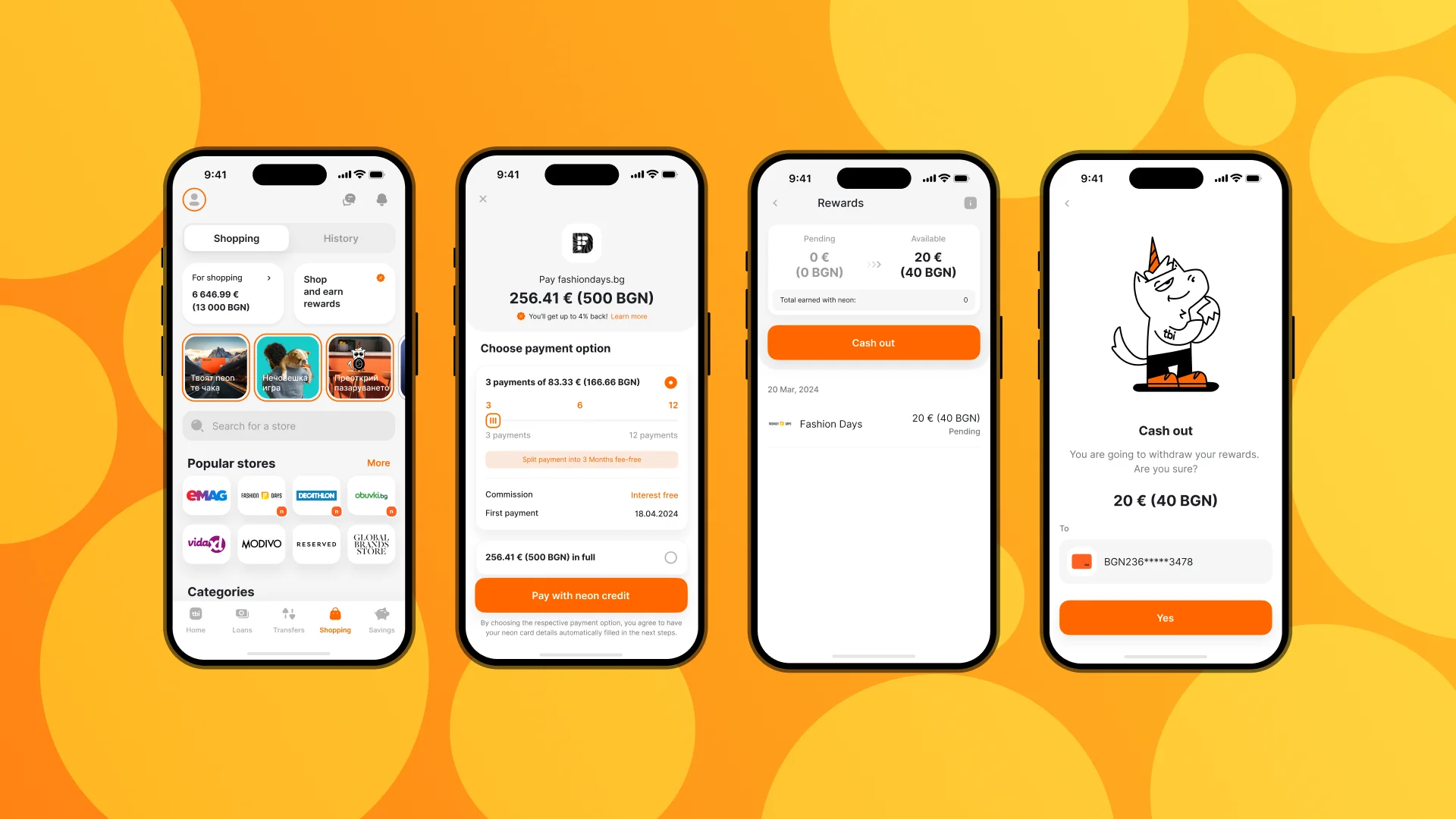

TiBi the Unicorn is the tbi app's cheeky animated mascot. It makes the interaction easier, communicates with users on behalf of the bank and maintains customer loyalty.

Unified widgets

Romania, Greece, and Bulgaria share a single interface foundation. The widgets are the same, but the emphasis shifts to match each market’s specifics: what matters to the user, how they are used to performing operations, and what local requirements apply.

Enhanced capabilities of financial management

The tbi app has all the features of a standard banking application. Some of these industry benchmarks are quite new, so let’s take a closer look at them.

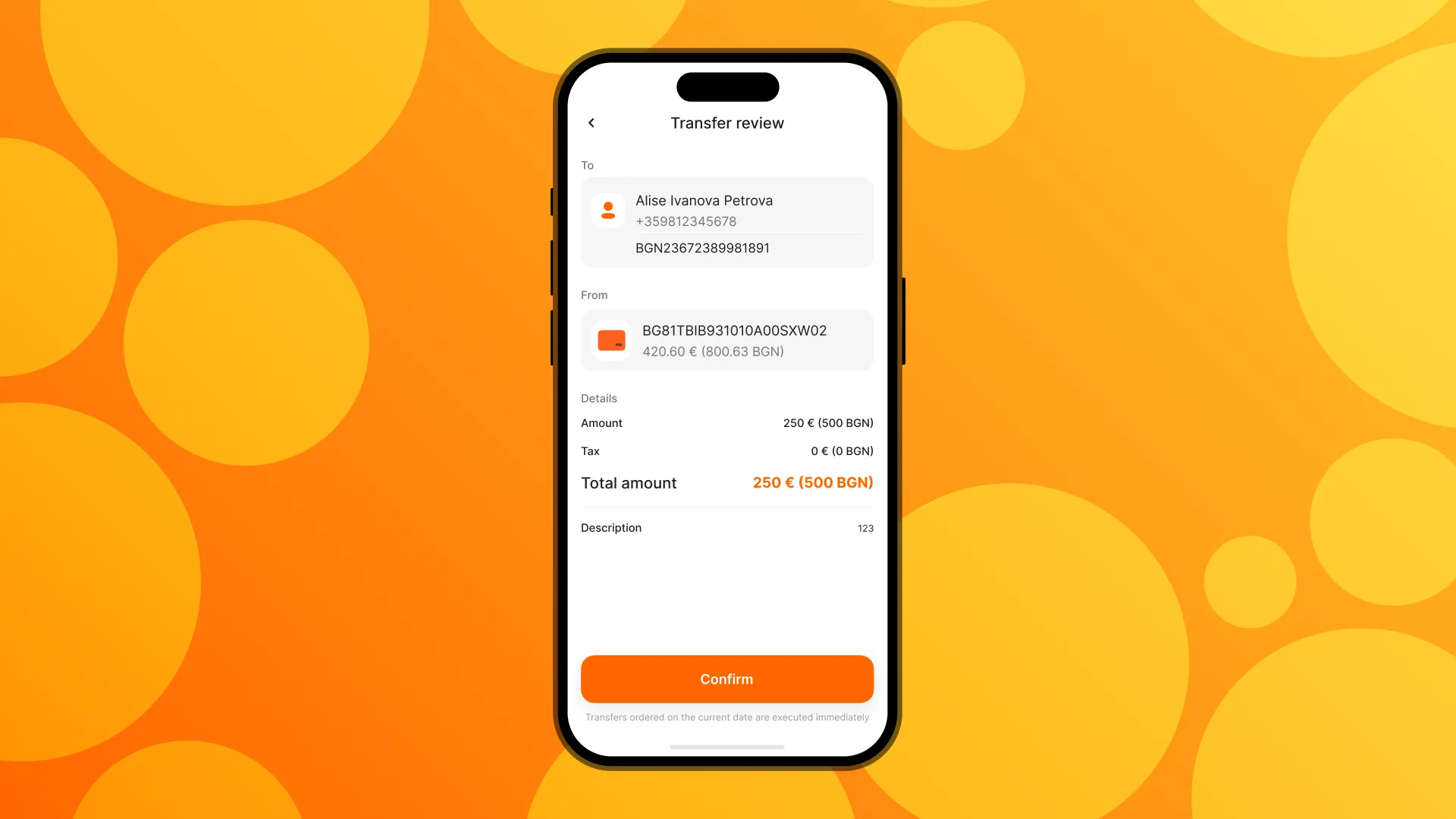

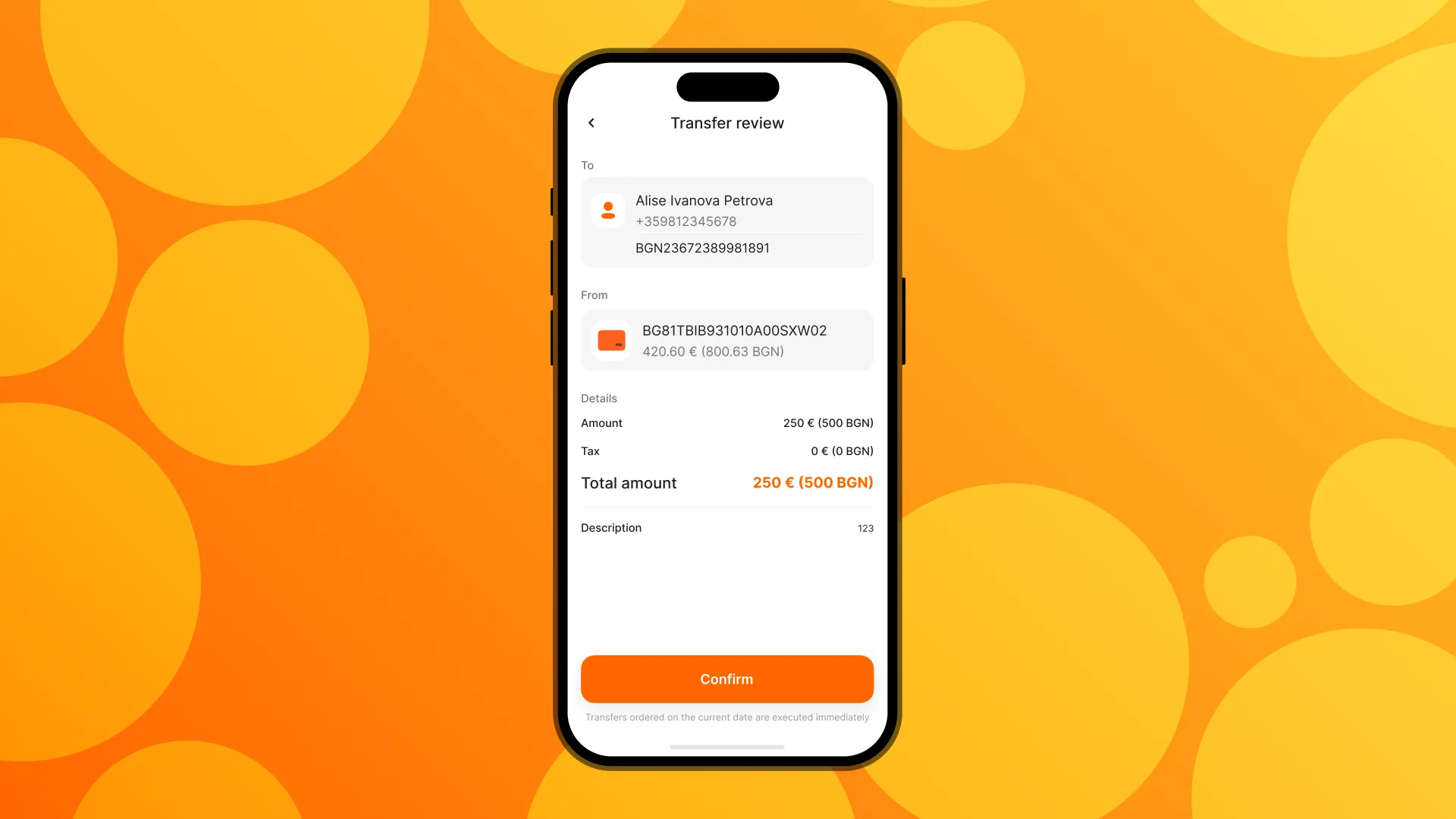

- Blink transfers are very new to Europe — no one had access to this service until recently: the user can make a transfer by phone number to a customer of any bank in the EU.

- Transfers to other tbi clients by phone number.

- Making purchases using Apple Pay and Google Pay.

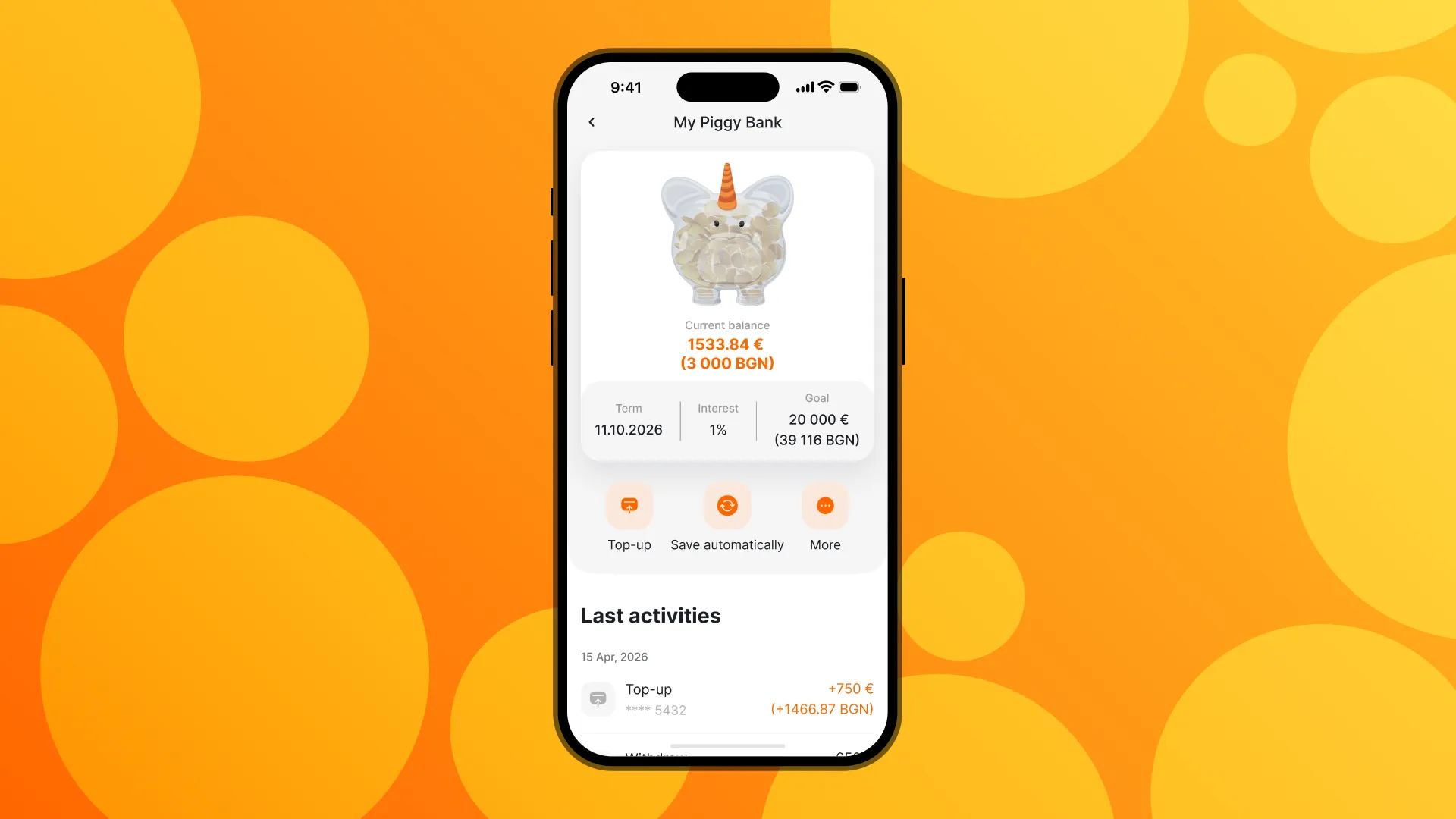

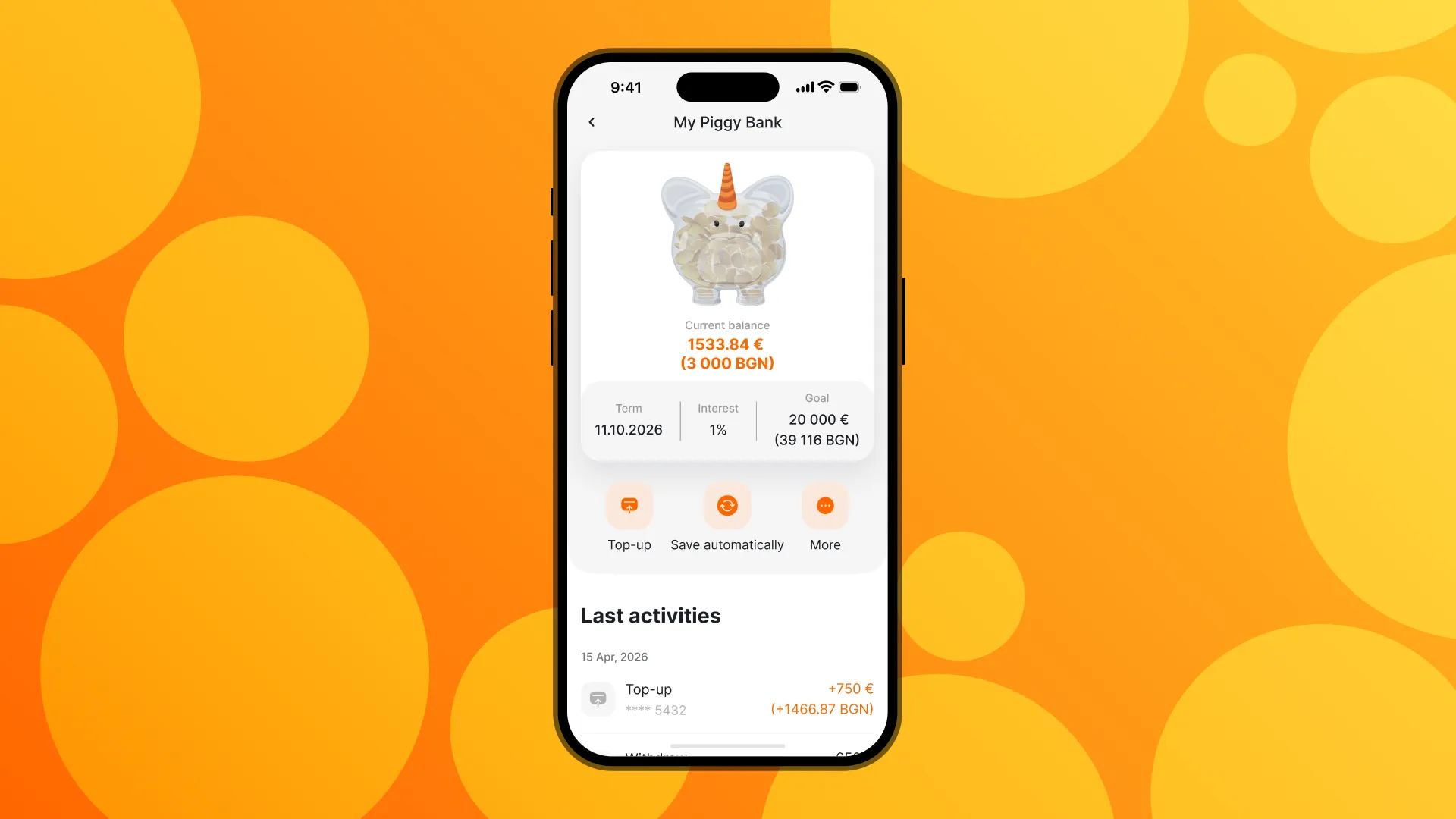

A convenient digital «piggy bank»

The user specifies the amount they want to accumulate and the term by which they need to do it. Each month, the app automatically transfers money from the user’s funds to collect the required amount. The user can also set up automatic rounding of purchases: the app will send the amount you need to round up into the piggy bank.

- Deposits. Monthly interest with savings at one of the highest rates in Bulgaria.

- Cashback from partners. The app has more than 50 partner sites on which the user can make purchases and get a profitable cashback.

- Split payments. The user can make a purchase, return the money and then divide this payment into several parts — three, six or nine months. If the customer chooses three or six months, the bank will not charge any interest.

- 24-hour online chat support. tbi is the only bank in Bulgaria that provides chat support 24 hours a day.

You can pay for utilities and even taxes directly in the application as well.

Convenient credit functionality

Simple credit application process. A new user can register and immediately apply for a credit loan.

Quick and flexible calculation of the pre-approved credit. The bank calculates the loan amount and the credit rate in less than five minutes taking into account how long the user has been a bank customer for.

In addition:

- Credit holidays.

- Reduction of monthly credit payment.

- Credit restructuring — combining several loans into one.

- Top-up loan — extension of existing credit.

- Regular payment — an option you set up once, and the charge is made automatically.

- Auto-payment — an option that automates the monthly charge so you don’t miss due dates or track them manually.

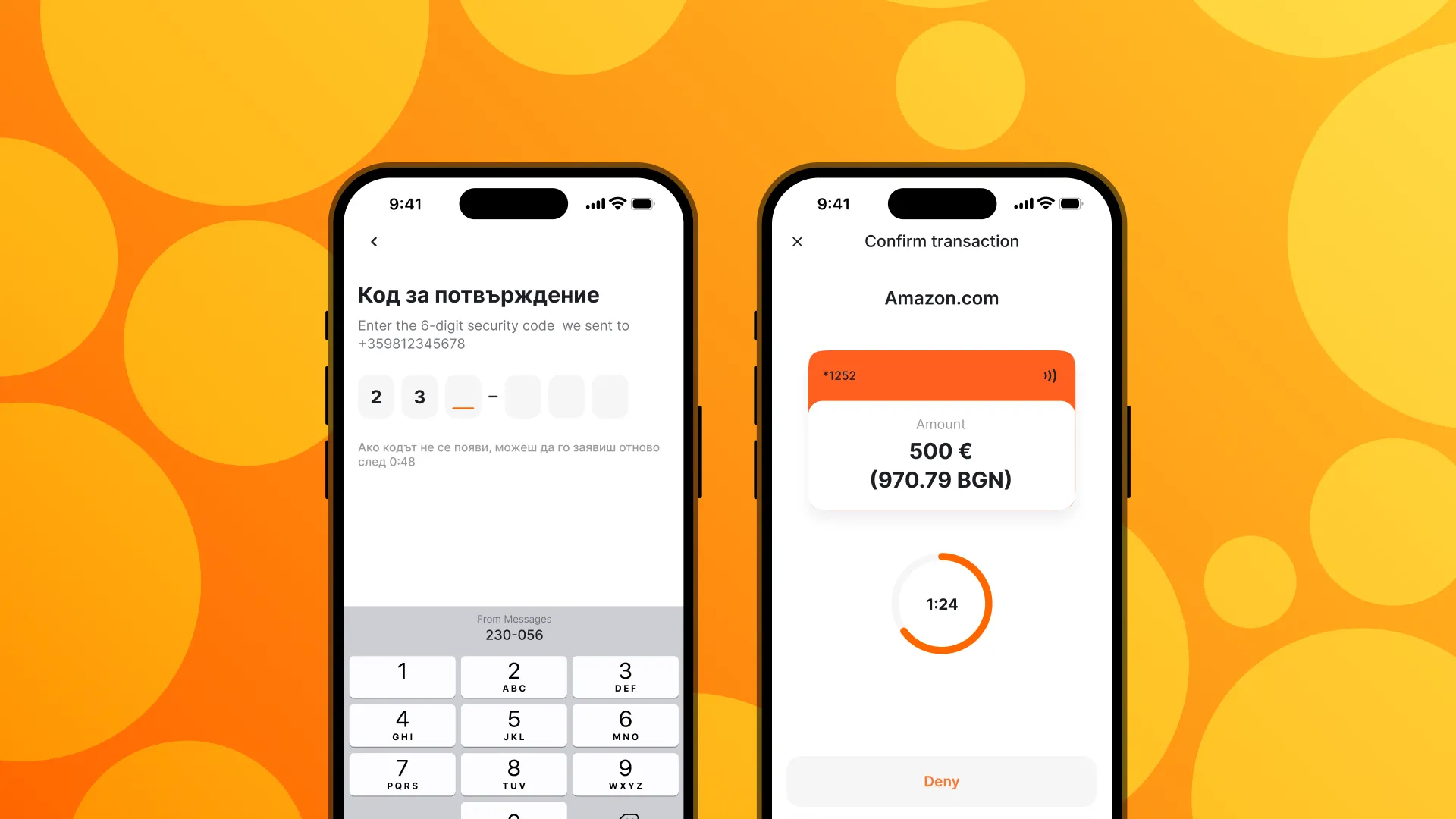

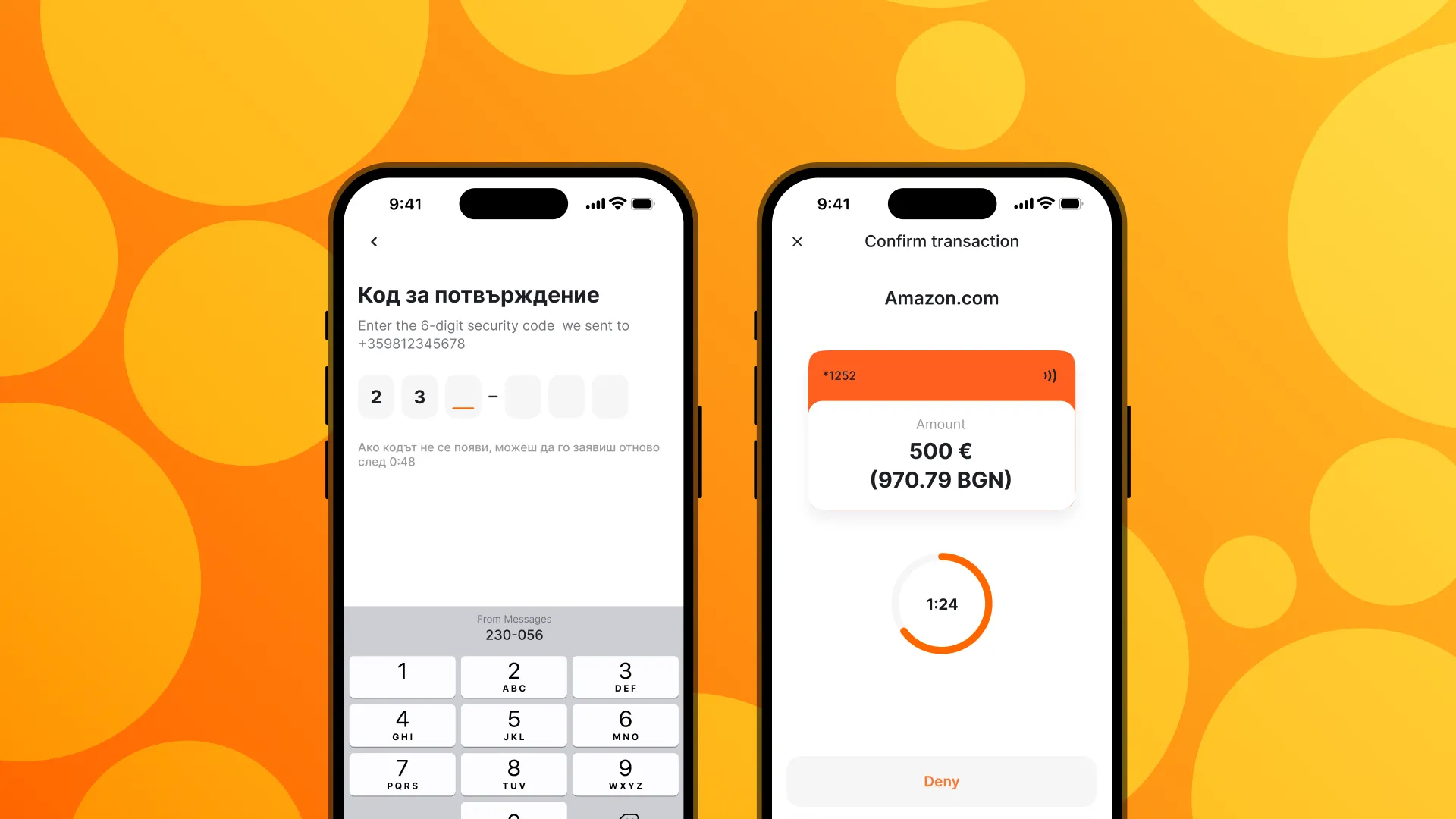

Security

Two-factor payment confirmation via 3DS authentication. To confirm a payment in the app, the user enters a verification code from a text message sent to their phone number.

Transaction confirmation in the app. If the user makes a big purchase, the application will send out a push notification notifying them: «You just made a purchase of €1,000 on Amazon. If this isn’t you, cancel the transaction».

Quick Identification. Previously, the user had to photograph their ID from both sides when registering. Now, the user just needs to turn their camera on and move their head from side to side. This is impossible to fake or imitate.

The user is highly protected from hacking, and their finances — from theft. They receive notifications of login attempts and can view the list of devices from which they are authorized. Users can also remove foreign or unnecessary devices from this list.

Shopping App

The app now includes a dedicated section where users can shop on partner websites without switching to an external browser. Everything happens within the bank’s environment: choosing a product, placing an order, and paying for it. All transactions are processed through TBI cards, keeping the experience consistent and secure.

If a purchase requires financing, it can be converted into a loan or installment plan right away. The application is submitted directly in the app, the decision is made quickly, and the limit and terms are shown immediately.

Signing documents online

The client no longer needs to visit the office to sign documents. Everything happens in the app: when a new document package is ready, they receive a push notification, and signing becomes immediately available in the notifications section. The document can be viewed, checked, and approved right on the phone. Confirmation is completed with a one-time code sent to the client.

The results

- App Store rating of 4.8 stars, Google Play rating of 4.7 stars.

- MAU — the average user growth in the span of a year: 122,000 users in 30 days, 65,000 in 7 days and 13,300 per day.

- Average engagement time per session grew from 10 to 16 minutes in a year.

- The crash-free users score is 99,53%.

- The tbi app is a big contribution to the development of fintech in the whole region. The bank has reached a new service standard, and its customers no longer need to plan visits to the office or wait in line.